With a challenging environment for businesses continuing one year on from the tumultuous events of last year’s mini budget, Investment Manager Rahul Misra delves into what creative businesses need to know. In our latest monthly investment insights for the creative sectors, Rahul covers:

- The current landscape of interest rates and inflation

- A slowdown in funding for startups

- Some bright sparks for the funding and collaboration in the creative industries

- How creative businesses can continue to attract investment in tough times

- Who’s making noise in the music sector

Rahul Misra, Investment Manager, Creative UK

What are three things happening in the investment space that are relevant to creative businesses?

- All eyes on interest rates

Today (21 September 2023), the Bank of England Monetary Policy Committee voted to hold base interest rates at 5.25%, the first pause in interest rate increases since November 2021.

Data released on Wednesday, 20th September, showed UK CPI inflation unexpectedly slowing despite a rise in fuel prices, along with a significant drop in core inflation (a measure of inflation excluding food and energy). This comes as welcome news and on the back of a consistent reduction in inflation indicators in recent months. However, inflation remains high and well above the Bank of England target of 2%, which means the high interest rate environment is likely to persist. It is a balancing act though, as the BoE will have to consider the impact of consistently high interest rates on borrowing costs for individuals and business, and the consequent impact on economic growth or lack thereof.

The main takeaway here is that creative businesses must brace themselves for what could well be a persistent high interest rate and inflation environment. This affects borrowing costs, client budgets and operational expenditure, so while there is a natural tendency for companies to reboot and reset after the summer, perhaps this is a time for muted enthusiasm.

2. A challenging first half of the year for startups

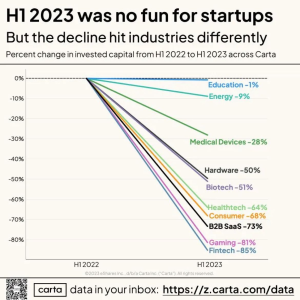

We’ve seen some numbers around how the first half of 2023 went in terms of funding for startups and the overall picture is not great. There’s been a significant reduction in the invested capital in startups, with numbers reflecting sectors from both creative and non-creative industries. Interestingly, growth sectors that have – in recent years – received the highest proportion of VC capital, have also seen the largest drop. In the games sector for example, we’ve seen an 80% reduction in invested capital, with deal value more concentrated in late-stage companies than previously.

There are reasons to believe that things may be more positive as we move into 2024. As the macroeconomic environment evolves, investors may have higher appetite to deploy uninvested capital, or ‘dry powder’ as the VC industry calls it. We come back later to how creative startups and scaleups can best position themselves.

There are also longer-term changes taking place through planned deployment of pension fund capital in UK’s innovation economy that could mean a step towards greater liquidity for VCs and the startup ecosystem, but it’s early days.

Source: Carta 2023

3. New funding opportunities from UK-EU partnership

We recently heard the news that the UK has struck an agreement with Horizon Europe and this very tangible collaboration between the UK and Europe has a positive impact on the funding that is available for research and development in the UK. While news of this partnership has made much of the impact on science industries, Creative Industries are also set to benefit from a programme that is all about increasing the innovation capacity and competitiveness of Europe’s startup and creative communities. After a three-year hiatus from the programme, rejoining Horizon unlocks the UK’s access to Horizon Europe funds and enables us to benefit from €170m made available by the new European Knowledge and Innovation Communities.

This news comes on the back of the UK Government’s Creative Industries sector vision published earlier in the summer – making the creative and cultural industries a priority area for investment – which will result in £230m of government investment since 2021 including £77m of new money to be invested in creative clusters, SME investment, and skills development.

What is the biggest challenge for creative companies seeking investment?

The main challenges for creative SMEs, which I have already alluded to, stem from the high interest rates environment.

High interest rates mean higher cost of borrowing for creative SMEs. But they also mean higher borrowing costs and lower discretionary budgets for the corporate clients that creative SMEs may be supplying. And, making this a triple whammy, the higher cost of capital means a drying up of funding from VCs and other investors.

So, how can creative SMEs best position themselves? Creative founders and entrepreneurs know this better than us, but here are some approaches from an investor perspective.

For those raising equity investment, it may be prudent to limit the amount of funding raised and to focus on cost reduction while the cost of capital remains high. A pragmatic approach to valuation targets (ie: not being over-ambitious and leaving some upside for future rounds) would also be well-advised at this time. This may be an opportunity to invest time into your growth story (your ‘storytelling’) by tying your product strategy with your funding strategy – not just for the immediate round of funding sought, but future rounds as well. This could position companies well for the long-term, as liquidity improves in the startup ecosystem.

For businesses that are raising debt, this is the time to focus on affordability and to make sure you’re not taking on loans that will lock you into a high cost of capital amidst economic uncertainty.

In the current environment it also becomes imperative for creative SMEs to conduct their own due diligence on current and prospective clients.

If working with larger corporates there is longer trading history to consider, but it’s worth looking into this history and ensuring that you can be confident they will be able to meet payment requirements for your projects.

Sector focus: music and the movers and shakers of the last month

We’ve just seen the value of British music exports surpass 700 million and at the same time we’ve got some interesting movements in the streaming industry that may be about to shake things up.

Universal Group and Deezer have struck a new deal which reshapes the economics of music streaming. This marks the first time the business model for music streaming has been reviewed since Spotify was launched in 2008, which is really quite remarkable. The deal gives a higher weighting to professional artists (those with more than 1000 listens a month) meaning that they will now earn higher royalties than their fledgling counterparts. The new system also adds greater weight to royalties if a musician is actively searched for, with a user search for an artist counting as four streams.

Alongside that, there’s also been a new partnership between PRS and a music tech company called Audoo, the aim of which is to improve royalty distribution for over 300,000 artists. It will do this by installing listening boxes in British businesses such as cafes and bars to help ‘drive transparent royalty distribution’, while being GDPR compliant.

So, there’s a lot of movement kind of going on in terms of the balance of power between platforms and artists. And one final development in the music space is the case of DAACI, a London-based AI music firm, that has acquired two music tech startups with the aim of creating the ‘ultimate creative AI ecosystem,’ that is stated to be about generating new art, rather than replicating existing music.

What are the new programmes and events that businesses need to know about?

- Creative UK Investment Conference North East, Newcastle, 27 September

- Barclays – Exploring the Dynamic Impact of AI on Creative Industries, Bristol, 28 September

- ESI London 2023 (e-sports industry festival), London, 19-20 October

- PEC report: Northern England’s Creative Industries

- PEC report: Estimating the Contribution of Arts, Humanities and Social Sciences (AHSS) R&D to Creative Industries R&D

- Creative Enterprise Female Founders screen business support programme now accepting applications

- Creative Enterprise screen business support programmes (Foundations and Scaling Up) opening for applications from 6 November

If you’d like to learn more about the investment offerings available through Creative UK, visit our Investment web pages here.

Related stories